-Look by Joe Signorella, CFP®, RICP®

How this Annuity Review “Look” will help you.

Annuities have become a hot topic in today’s financial world for several reason.

- Stock Market volatility with downturns in the 30% range have crushed retirees portfolios that don’t have enough time to recover

- 10,000 Baby Boomers a day retire and look to secure a monthly income check from their “nest egg” portfolios.

Investors like you doing research on annuities to combat the above concerns are finding it more difficult with all the different types of annuities like “hybrid” annuities, equity linked annuities, buffer annuities, fixed index annuities (FIA) and variable annuities. More moving parts in these annuities make it hard to get to the end game simple solutions of “Will this investment help me in retirement?”. As a CFP®, Certified Financial Planner, I am a Independent Fiduciary and have to do what is best for you. Let’s get started.

What Will We Cover in this Annuity Review?

In the last handful of years annuities have become more integrated in the financial plan of future retirees. Annuities now have powerful optional features that focus on income riders, extended home healthcare income enhancements, enhanced death benefits and different confusing interest crediting methods. Famously marketed as “hybrid annuities” which combine various optional features of other annuity types. Sadly, there’s a lot of misinformation about how they really work and should be used in your financial plan. In this annuity “Look” or review, we will be going over annuity details of the Global Atlantic Forethought ForeAccumulation II aka ChoiceAccumulation II fixed indexed annuities, regarding:

- Investment type

- Rates

- Optional Riders

- Fees

- Return expectations

- How it is used- Pros and Cons

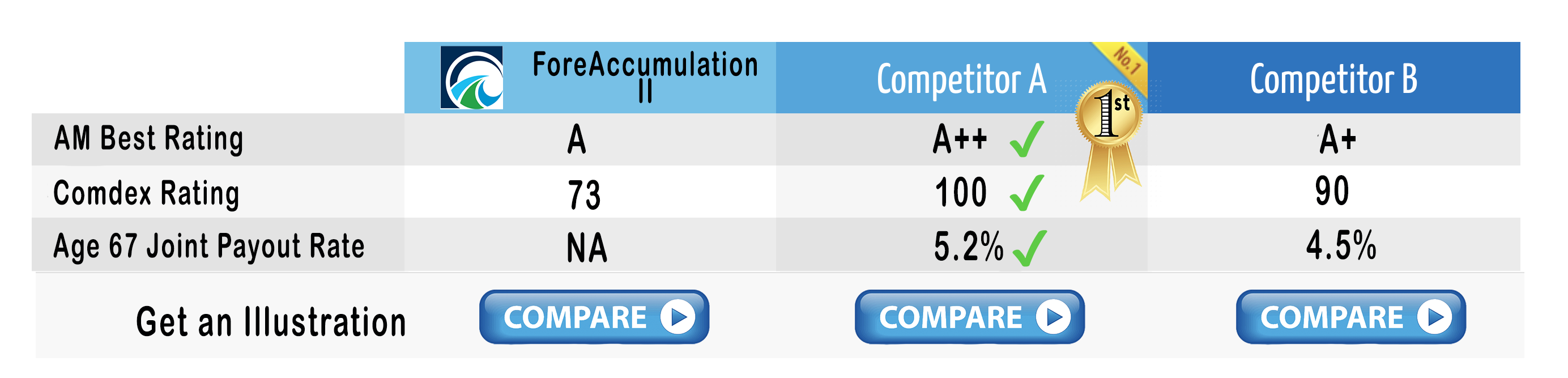

Comparison:

Table below will update as the competition changes. Currently, there are some competitors to the Forethought ForeAccumulation 2 fixed index annuity. To request a side by side, click on the compare button below and our Certified Financial Planner® will be happy to answer any question you might have (Click Here).

Servicing the retirement income planning market has grown in popularity as baby boomers and retirees search for options to protect against market volatility and secure lifetime income. Annuities are one of the few strategies that can accomplish both secured growth and guaranteed income. According to Life insurance industry group LIMRA, in 2018 over $132 billion in fixed annuity annual sales occurred. With Fixed Indexed annuities sales projected to grow nearly forty percent by the year 2023. A turbulent stock market encourages investors to seek less risky havens for their money, such as fixed annuities, said Todd Giesing, director of annuity research at LIMRA.

Annuities come in different specialties and many annuity carriers have different products within the same categories such as three different fixed index annuities. Each having a different focus such as secured growth or death benefits as examples. Along with different available riders or options attached to your annuity, one annuity product could be completely different from your neighbor with the same named annuity but without certain riders attached.

Fiduciary Annuity and Retirement Income Planning Information From a CFP®

In 2017 Department of Labor’s fiduciary rule being struck down in federal court of Appeals has been especially helpful in the sales of indexed annuities. The rule, which raised investment-advice standards in retirement accounts, would of made brokers and insurance agents become fiduciaries to sell indexed annuity and other financial products opening up potential lawsuits from “bad” sales of annuity products. Unfortunately, that didn’t rule holding agent up to a higher standard, as a fiduciary, did not pass.

Our annuity review also called “look” is overseen by our in house Certified Financial Planner® that has to put you first, as a fiduciary thru the CFP® Board so you will have the confidence to use these annuities in your retirement plan after our reviews. Let’s get to it.

Annuity Company Issuer Review: Global Atlantic

Since this investment is usually for the long term such as 10 years, it is important that the annuity company itself is financially sound. The guarantees in the annuity are back by the insurance company and not from a government agency. However each state’s Guaranty Association has a dollar amount, usually $100,000, that it will refund if an annuity carrier went bankrupt. Think of it as a second layer of protection.

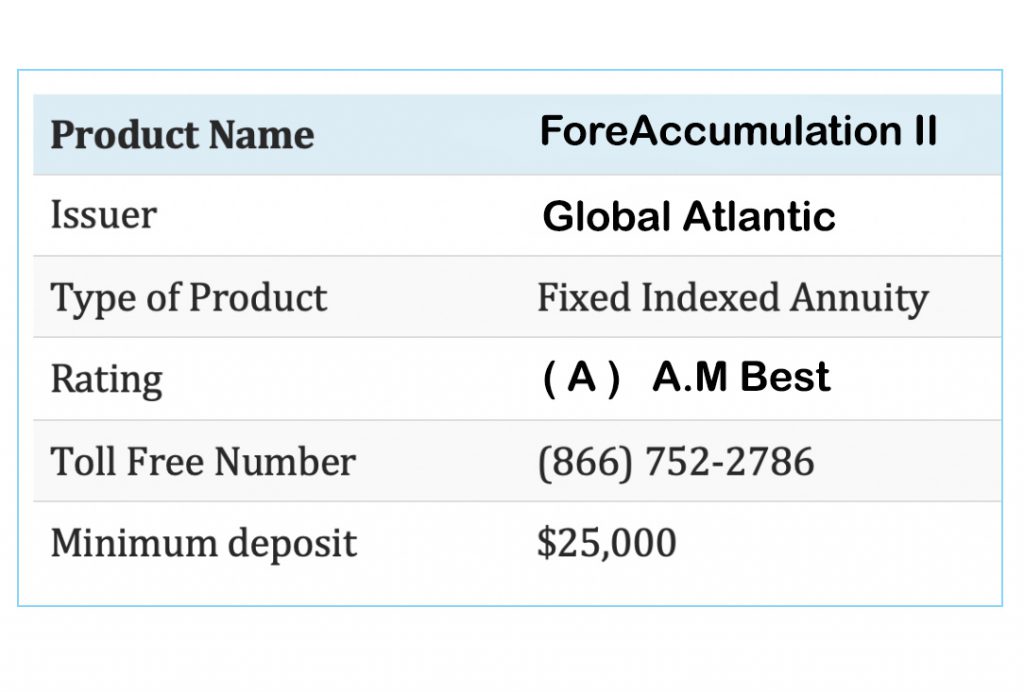

Forethought Life Insurance Co. became a subsidiary of Global Atlantic Financial Group Limited in 2014. Global Atlantic Financial Group Limited, through its subsidiaries, offers a broad range of retirement, life and reinsurance products. The Company provides a variety of options to assist in custom strategies for protection, accumulation, income, wealth transfer and end-of-life needs. . Forethought issues life insurance policies and annuities and names their products from two different sales channels, Independent and broker/dealer. The Global Atlantic ForeAccumulation II (broker/dealer channel) and ChoiceAccumulation II ( Independent channel) as the same products. The products are all marketed under the Global Atlantic brand. Global Atlantic is a private company, meaning it is not listed on a stock exchange, is rated “A” (Excellent) by A. M. Best Company (as of November 2019) and Standard & Poor’s giving Forethought an “A-” rating. It has over $20 Billion in assets and a Comdex score of 73.

Forethought Life Insurance Co. became a subsidiary of Global Atlantic Financial Group Limited in 2014. Global Atlantic Financial Group Limited, through its subsidiaries, offers a broad range of retirement, life and reinsurance products. The Company provides a variety of options to assist in custom strategies for protection, accumulation, income, wealth transfer and end-of-life needs. . Forethought issues life insurance policies and annuities and names their products from two different sales channels, Independent and broker/dealer. The Global Atlantic ForeAccumulation II (broker/dealer channel) and ChoiceAccumulation II ( Independent channel) as the same products. The products are all marketed under the Global Atlantic brand. Global Atlantic is a private company, meaning it is not listed on a stock exchange, is rated “A” (Excellent) by A. M. Best Company (as of November 2019) and Standard & Poor’s giving Forethought an “A-” rating. It has over $20 Billion in assets and a Comdex score of 73.

Annuity Review: Global Atlantic Forethought ForeAccumulation II

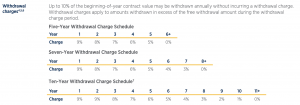

Surrender Fees:

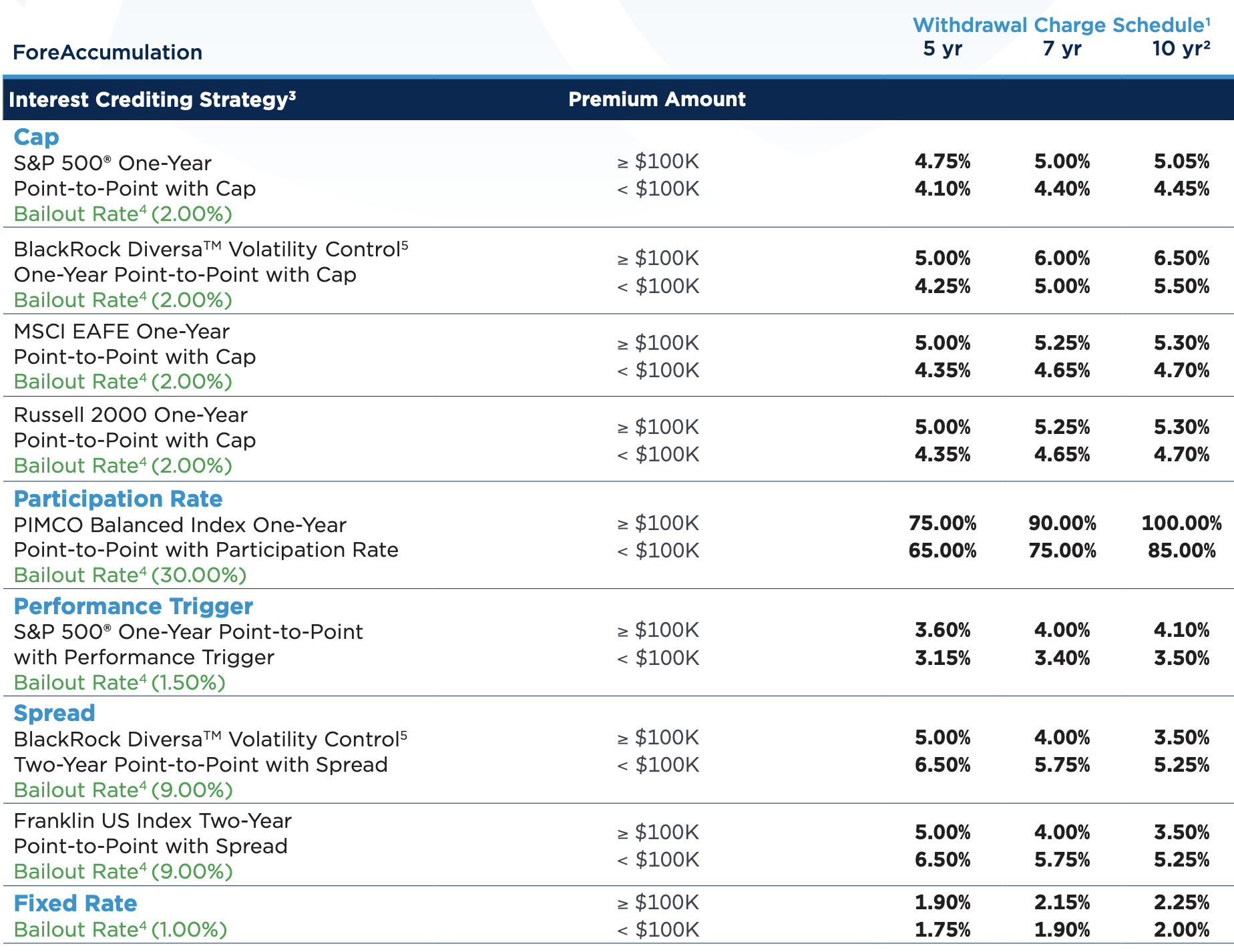

Surrender charges/fees and periods for this annuity are the typical of most indexed annuities. Most fixed index annuities will have a 5 year, 7 year, 10 year, and 14 year surrender variation to choose from. Typically an annuity with a number in the product name with also most likely dictate the surrender period. Taking the longer surrender period will most likely give you a larger cap on indexes and a larger fixed rate option for index crediting. Typically fixed index annuities allow you to withdraw 10% of your accumulation value after the first year without surrender fees. However if you are under age 59 and a half, you are subject to a 10% IRS tax penalty as well as income taxes applied to the withdrawal.

Forethought ForeAccumulation II Index Annuity Series has the surrender charge option as seen above which coordinate with the duration of the annuity. ForeAccumulation 2 also has a 5 year, 7 year and 10 year surrender charge annuities to choose from. You can also take out ten percent of your value starting in year 1 without a 10% penalty each year. If you are under age 59 1/2 there is a 10% IRS tax penalty on any dollars taken out.

Earning Interest:

Indexed annuities do a lot of things to confuse investors. Too many moving parts when it should be a simple two part calculation. The two parts are index crediting and income crediting. See most index annuities have two values that are tracked each year. The accumulation value account or (walk away money) and income value account (Lifetime income calculation value).

The accumulation value account will be based on your chosen crediting method based on an index. Examples are Annual point-to-point or Participation rates. Each year this is calculated and showed on your annual annuity statement under names like annuity value or accumulation values.

The accumulation value account will be based on your chosen crediting method based on an index. Examples are Annual point-to-point or Participation rates. Each year this is calculated and showed on your annual annuity statement under names like annuity value or accumulation values.

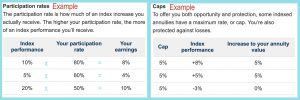

The income value is usually calculated on some “bonus” or “roll up rate” each year with a maximum of ten years. This roll up rate can be simple interest or compound interest. Simple interest would be the same calculate interest every year ( 5% simple interest for 4 years at $100,000 deposit would equal $5,000 credit each year for 4 years). Compound interest would be calculated as follows ( 5% compound interest at $100,000 deposit would equal $5,000 credit first year, $5,250 year 2, and $5,512 year 3). Then the income value is multiplied by an age range percentage band to calculate your guaranteed lifetime income payment. Income values can also be called protected payment base or protected income value. Bailout Rate in the interest crediting strategy represents the “walk away” rate that allows you to not have surrender charges accessed.

Global Atlantic Forethought ForeAccumulation II offers a variety of Interest-Crediting Options.

- S&P 500® Index: 1-Year Point-to-Point with Cap

- S&P 500® Index: 1-Year Participation Rate with Spread

- PIMCO Balanced Index 1-Year Point-to-Point

- PIMCO Balanced Index 1-Year Participation Rate

- BlackRock Diversa Volatility Control 1-Year Point-to-Point

- BlackRock Diversa Volatility Control 2-Year Point-to-Point

- Russell 2000® Index 1-Year Point-to-Point

- MSCI EAFE Index 1-Year Point-to-Point

- Franklin US Index 2-Year

- Fixed Account Option

Income features?

The Global Atlantic Forethought ForeAccumulation II annuity does not offer an income rider only an enhanced death benefit rider.

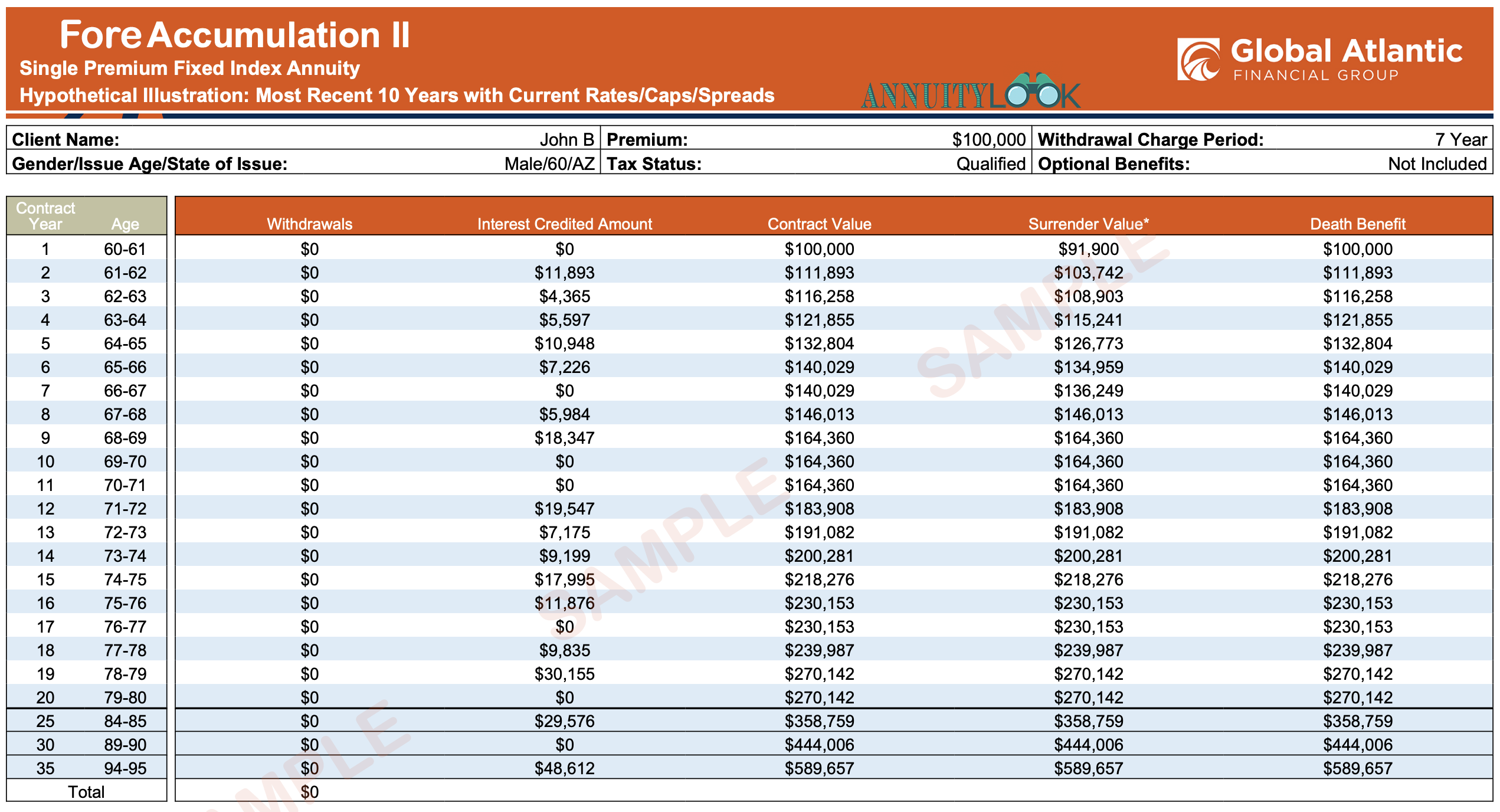

This is a sample Forethought ForeAccumulation II Illustration for a sixty year old male with getting “past historic” returns for their aggressive equity indexes. You can see the interest earned every year on the ForeAccumulation II indexed annuity in the fourth column from the right. Ask the agent for the 0% index credit option to show you what the worse case scenario will be to compare to the highly credited run agent illustration. See if any other index annuities from different companies will beat that amount. If you want to see if there are other annuities that can go up against the Global Atlantic Forethought ForeAccumulation 2 Indexed annuity, contact us via the Free Annuity Help form.

The Agent sales pitch for this annuity?

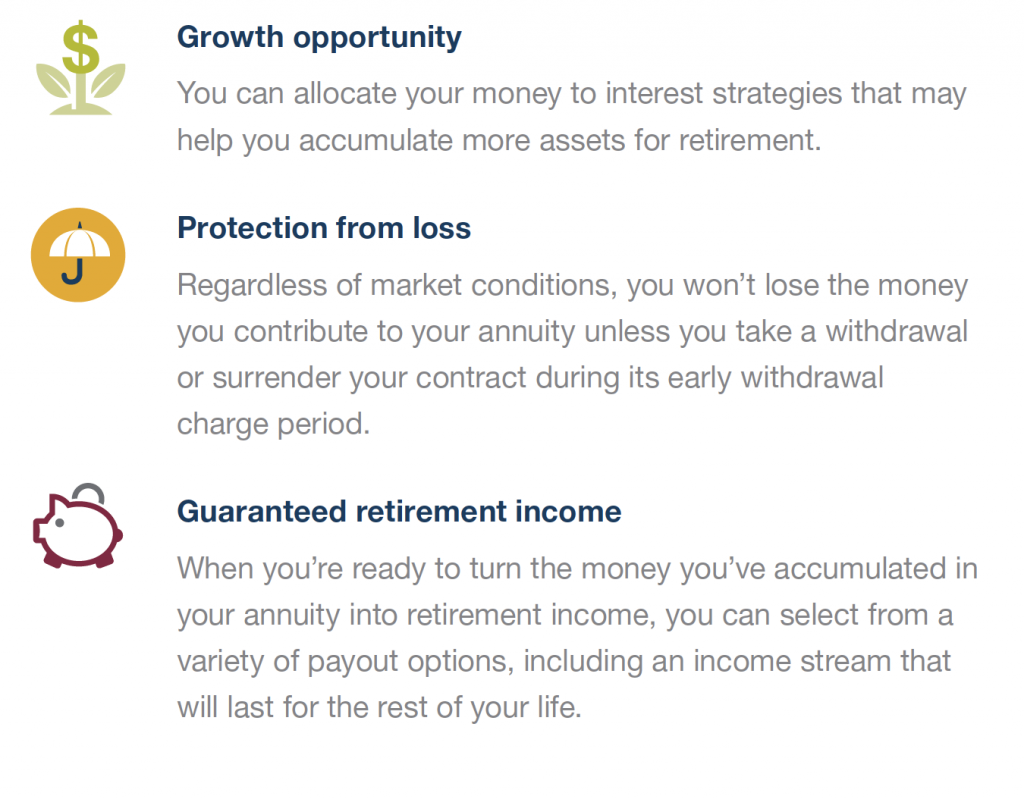

This indexed annuity, also called an equity-indexed annuity, FIA, fixed-index annuity or hybrid annuity, will likely be presented on three ideas:

- Principle protection with upside potential from index choices

- Death Benefit with Enhanced Death Rider 7% growth for 15 years

- Bonus money

The ForeAccumulation 2 Indexed Annuity is for investors that don’t want to worry about market volatility and will not need access to their money for longer than a handful of years.

Agent for this annuity have to tendency to inflated the index return rates. Remember that the index credits are capped at a lower rate than the index itself. Indexes are not being held like your mutual funds at Charles Schwab or Fidelity. They are options held on the indexes at the annuity carrier’s investment department. Most indexes described above will NOT include the dividends which historically represent over half the returns in the case of the S&P 500 index. Over the long term, this annuity will generate returns of 0-6%. Anything more is misleading. Agent can expect to receive 7% up front commission on the sale of this Indexed Annuity. This commission is paid from the annuity carrier to the sales agent. It is not directly taken from your initial deposit it is built into the caps, spreads, index crediting, and income dollars paid to you.

Pros and Cons -How to use this annuity for retirement?

First Pro is that your investment will never lose value if held for the surrender period duration. Think of FIA, Fixed indexed annuities as a bond or fixed investment replacement with a key benefit. Another Pro is that benefit is guaranteed income for life. Use the optional income riders and features to get the best of both worlds. Comparable fixed rate to the 5 year treasury note investment and income for life. Using your customized annuity illustration with 100% allocation to the fixed crediting account and utilizing the powerful income riders and features you can plan your retirement income needs at any point on the illustration. The Con is that your investment in not liquid like you would believe as the income value is dependent on your annual credits. Also the growth is lower than what the stock market can give you in returns over a longer period of time. FIA or Fixed Index Annuities are sometimes referred to as “Hybrid Annuity” which is a made up marketing term for this type of annuity. Hybrid refers to the income and protected growth the annuity can deliver.

Have questions about this Annuity?

If you’re considering this annuity and have additional questions, feel free contact us via our secure contact form. Our Certified Financial Planner™ professional (CFP®) will answer your questions FREE within 24 hours. I hope you found this look informative and found value in your time. Aloha!

Our lawyers made us do it, some legal disclosures…

This is an independent product review, not a recommendation to buy or sell an annuity. The annuity carrier has not endorsed this review in any way nor do we receive any compensation for this review. This is an independent review for you to see the pros and cons of this particular annuity. Before purchasing any investment product be sure to do your own due diligence and consult a properly licensed professional, preferably a certified financial planner® practitioner, should you have specific questions as they relate to your individual circumstances. All names, marks, and materials used for this review are the property of their respective owners.