-Look by Joe Signorella, CFP®, RICP®

What is the hottest selling retirement annuity in 2021?

Annuities have become a hot topic in today’s financial world for several reasons.

- Stock Market volatility with downturns in the 30% range have crushed retirees portfolios that don’t have enough time to recover

- 10,000 Baby Boomers a day retire and look to secure a monthly income check from their “nest egg” portfolios.

Investors like you doing research on annuities to combat the above concerns are finding it more difficult with all the different types of annuities like “hybrid” annuities, equity-linked annuities, buffer annuities, fixed index annuities (FIA), and variable annuities. The best selling retirement annuity of 2021 is the registered index-linked annuity (RILA), the $17.4 billion market for structured variable annuities– also sometimes referred to as an indexed variable annuity, structured variable annuity, buffer annuity, or a structured annuity – is essentially a blend of the best part of a variable annuity and limited downside protection of a fixed indexed annuity (FIA).

Started in 2010 with one company, these hybrid annuities do offer is a “limited loss” to an investor – between 10% and 30% of the market’s decline during a specified period usually a year period. For example, if a RILA, indexed linked or buffer annuity has selected the optional 20% S&P 500 index protection against a market loss over one year period, an investor’s account would lose only 8% of its value if the market dropped by 28% in that given year because of the buffer annuity protects the first 20% loss from the market.

The more loss protection or buffer you select, the less upside gain from the index you will receive. Brighthouse Financial Shield Level annuity has a 12% gain limit yearly on the S&P 500 index with a 20% buffer protection on year loss.

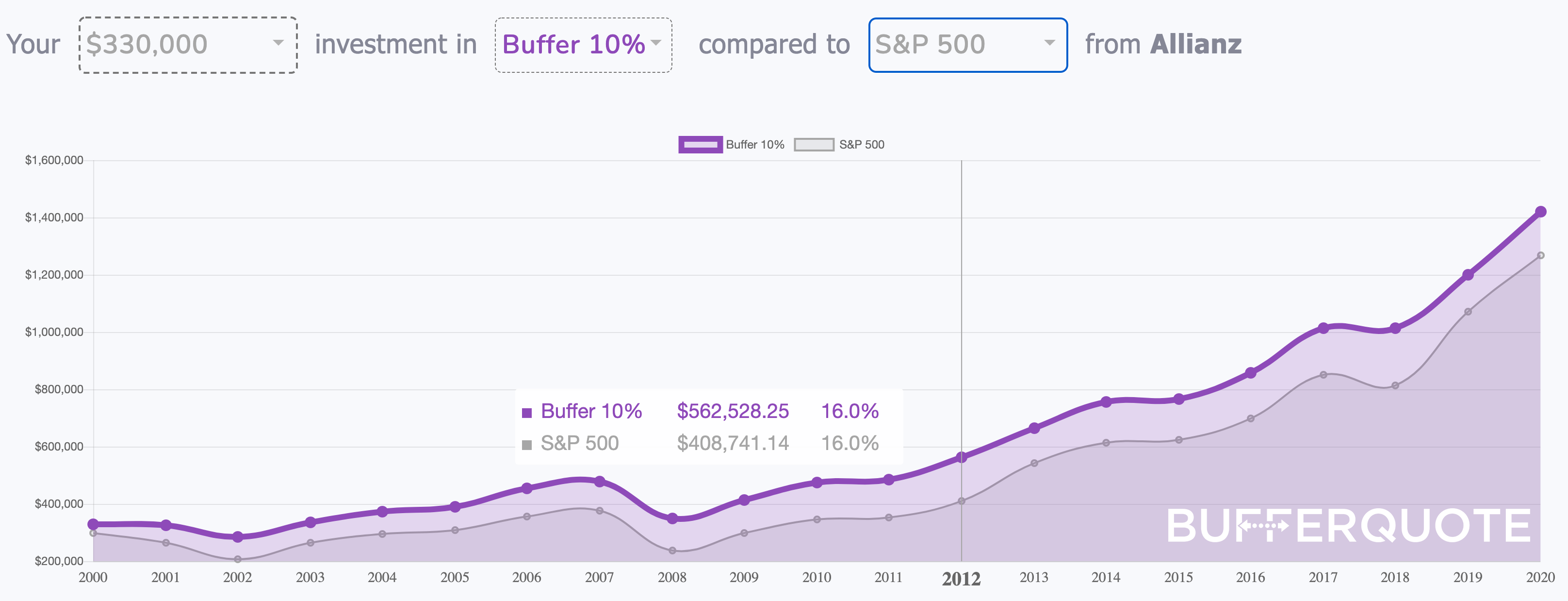

Taken from the interactive chart above the buffer annuity invested in the S&P 500 index over the last 20 years gain more than $86,000 than the S&P 500 index. That was an increase of 45% gain from limiting market losses with the 20% market protection each year. Click the chart to see how it works.

Only a small limited amount of annuity companies sell this product. However “The 100 Best Annuities for Today’s Market” annual article in Barron’s Magazine recognizes the index-linked variable annuity as one of the few best categories in the retirement planning tools. In addition to Brighthouse Financial’s Shield Level annuities, they are France-based AXA’s Equitable Structured Capital Strategies (SCS), Lincoln Financial’s Level Advantage annuity, Athene, and Allianz Index Advantage Variable annuity, and Prudential Flex Guard.

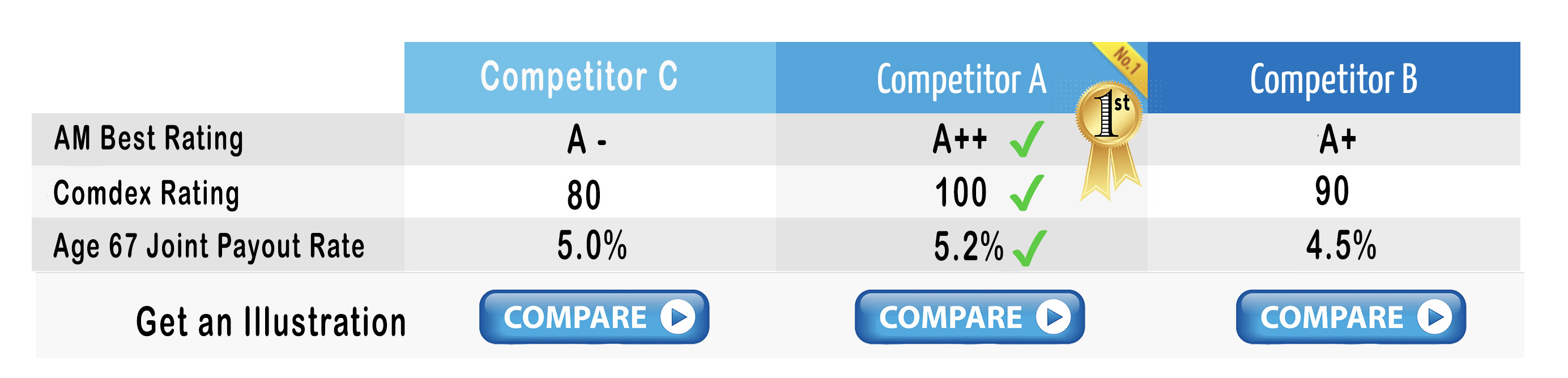

Comparison:

Table below will update as the competition changes. Currently, there are some great choices for retirement annuities. To request a side by side, click on the compare button below, and our Certified Financial Planner® will be happy to answer any question you might have (Click Here).

Servicing the retirement income planning market has grown in popularity as baby boomers and retirees search for options to protect against market volatility and secure lifetime income. Annuities are one of the few strategies that can accomplish both secured growth and guaranteed income. According to Life insurance industry group LIMRA, in 2018 over $132 billion in fixed annuity annual sales occurred. With Fixed Indexed annuities sales projected to grow nearly forty percent by the year 2023. A turbulent stock market encourages investors to seek less risky havens for their money, such as fixed annuities, said Todd Giesing, director of annuity research at LIMRA.

Annuities come in different specialties and many annuity carriers have different products within the same categories such as three different fixed index annuities. Each having a different focus such as secured growth or death benefits as examples. Along with different available riders or options attached to your annuity, one annuity product could be completely different from your neighbor with the same named annuity but without certain riders attached.

Fiduciary Annuity and Retirement Income Planning Information From a CFP®

In 2017 Department of Labor’s fiduciary rule being struck down in federal court of Appeals has been especially helpful in the sales of indexed annuities. The rule, which raised investment-advice standards in retirement accounts, would of made brokers and insurance agents become fiduciaries to sell indexed annuity and other financial products opening up potential lawsuits from “bad” sales of annuity products. Unfortunately, that didn’t rule holding agent up to a higher standard, as a fiduciary, did not pass.

Our annuity review also called “look” is overseen by our in house Certified Financial Planner® that has to put you first, as a fiduciary thru the CFP® Board so you will have the confidence to use these annuities in your retirement plan after our reviews. Let’s get to it.

Surrender Fees:

Surrender charges/fees and periods for this annuity are typical of most buffer annuities. Most fixed index annuities will have a 5 year, 7 years, and 10 years, surrender variation to choose from. Typically an annuity with a number in the product name with also most likely dictate the surrender period. Taking the longer surrender period will most likely give you a larger cap on indexes and a larger fixed rate option for index crediting. Typically annuities allow you to withdraw 10% of your accumulation value after the first year without surrender fees. However, if you are under age 59 and a half, you are subject to a 10% IRS tax penalty as well as income taxes applied to the withdrawal.

Registered Index-Linked Annuities (RILA) have the surrender charge option as seen above which coordinates with the duration of the annuity. You can also take out ten percent of your value starting in year 1 without a 10% penalty each year. If you are under age 59 1/2 there is a 10% IRS tax penalty on any dollars taken out.

Fee-Only planners have access to “Advisory or I- share fee advised” structured annuities, They usually have zero surrender charges, instant liquidity, and higher index rates. These planners charge annual fees to manage the indexes around 1.00% per year of assets in the annuity. Still, a better option as these fee-only RILA annuities have higher upside cap rates than the commissionable traditional RILA/ buffer annuities. Check out BufferQuote.com for available fee-only non-commissionable buffer annuities.

The Agent sales pitch for this annuity?

This RILA annuity, also called a buffer annuity will likely be presented on two ideas:

- Limited principal protection from index choices

- Higher index gains then FIA, Index annuities

The Registered Indexed-Linked Annuity is for investors that want to take some more risk for a potentially bigger market index gain. Investors are less aggressive, however than traditional variable annuity owners, who have no protection at all against market losses in the sub-accounts. Remember that the higher cap rates and nice downside protection are subject to change every year from the insurance carrier.

Have questions about this Annuity?

If you’re considering this annuity and have additional questions, feel free contact us via our secure contact form. Our Certified Financial Planner™ professional (CFP®) will answer your questions FREE within 24 hours. I hope you found this look informative and found value in your time. Aloha!

Our lawyers made us do it, some legal disclosures…

This is an independent product review, not a recommendation to buy or sell an annuity. The annuity carrier has not endorsed this review in any way nor do we receive any compensation for this review. This is an independent review for you to see the pros and cons of this particular annuity. Before purchasing any investment product be sure to do your own due diligence and consult a properly licensed professional, preferably a certified financial planner® practitioner, should you have specific questions as they relate to your individual circumstances. All names, marks, and materials used for this review are the property of their respective owners.