-Look by Joe Signorella, RICP®

What Will We Cover in this Annuity Review?

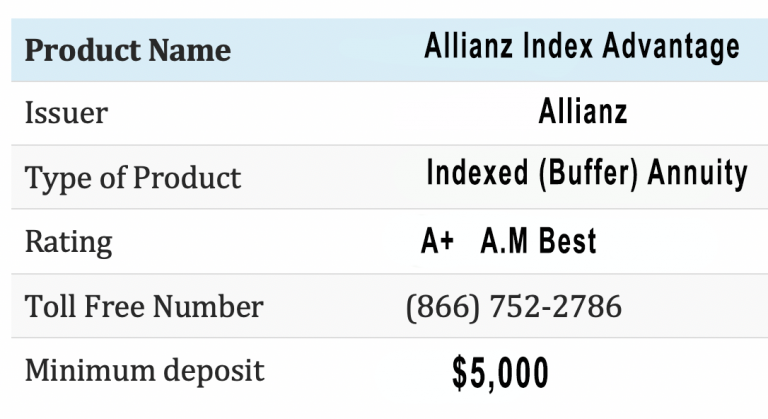

In this annuity review we will be going over annuity details regarding the Allianz Index Advantage

Variable annuity.

- Investment type

- Rates

- Optional Riders

- Fees

- Return expectations

Servicing the retirement income planning market has grown in popularity as baby boomers and retirees search for options to protect against market volatility and secure lifetime income. Annuities are one of the few strategies that can accomplish both secured growth and guaranteed income.

Investors like you doing research on annuities to combat the above concerns are finding it more difficult with all the different types of annuities like “hybrid” annuities, equity-linked annuities, buffer annuities, fixed index annuities (FIA), and variable annuities. The best selling retirement annuity of 2021 is the registered index-linked annuity (RILA), the $17.4 billion market for structured variable annuities– also sometimes referred to as a variable indexed annuity, structured variable annuity, buffer annuity, or a structured annuity – is essentially a blend of the best part of a variable annuity and limited downside protection of a fixed indexed annuity (FIA).

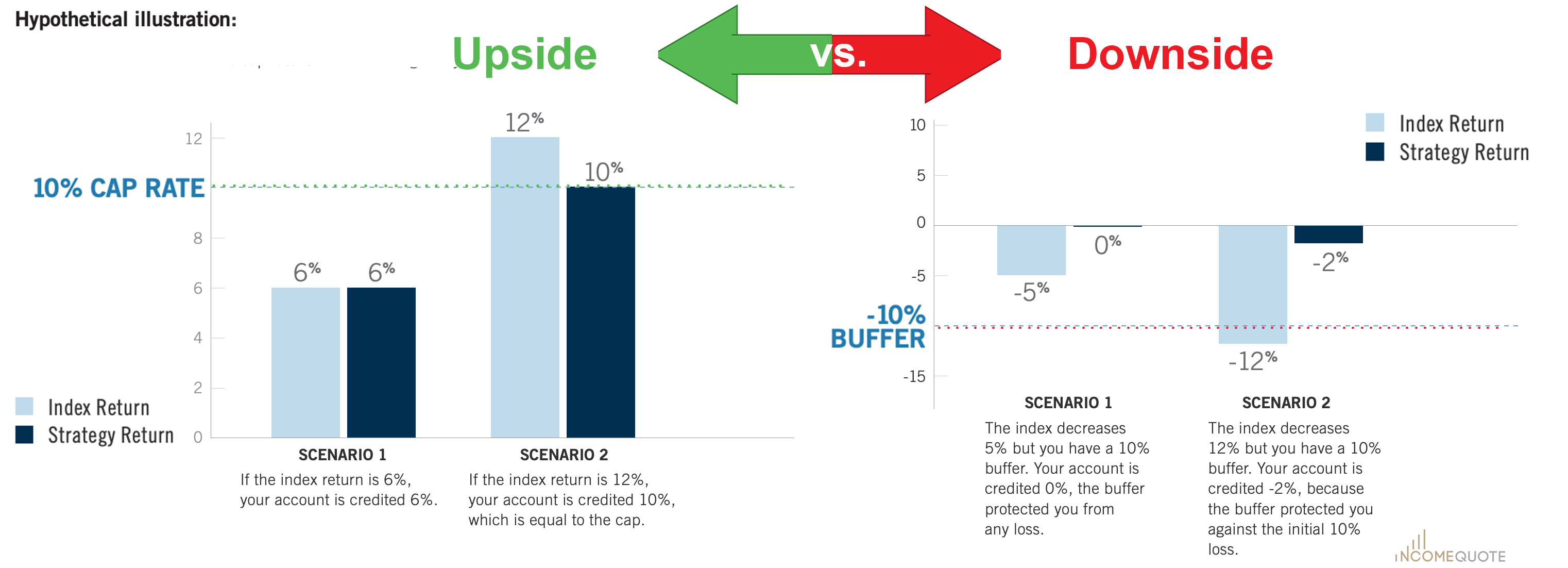

Started in 2010 with one company, these hybrid annuities do offer is a “limited loss” to an investor – between 10% and 20% of the market’s decline during a specified period usually a year period. For example, if a RILA or buffer annuity has selected the optional 20% S&P 500 index protection against a market loss over one year period, an investor’s account would lose only 8% of its value if the market dropped by 28% in that given year because of the buffer annuity protects the first 20% loss from the market.

The more loss protection or buffer you select, the less upside gain from the index you will receive.

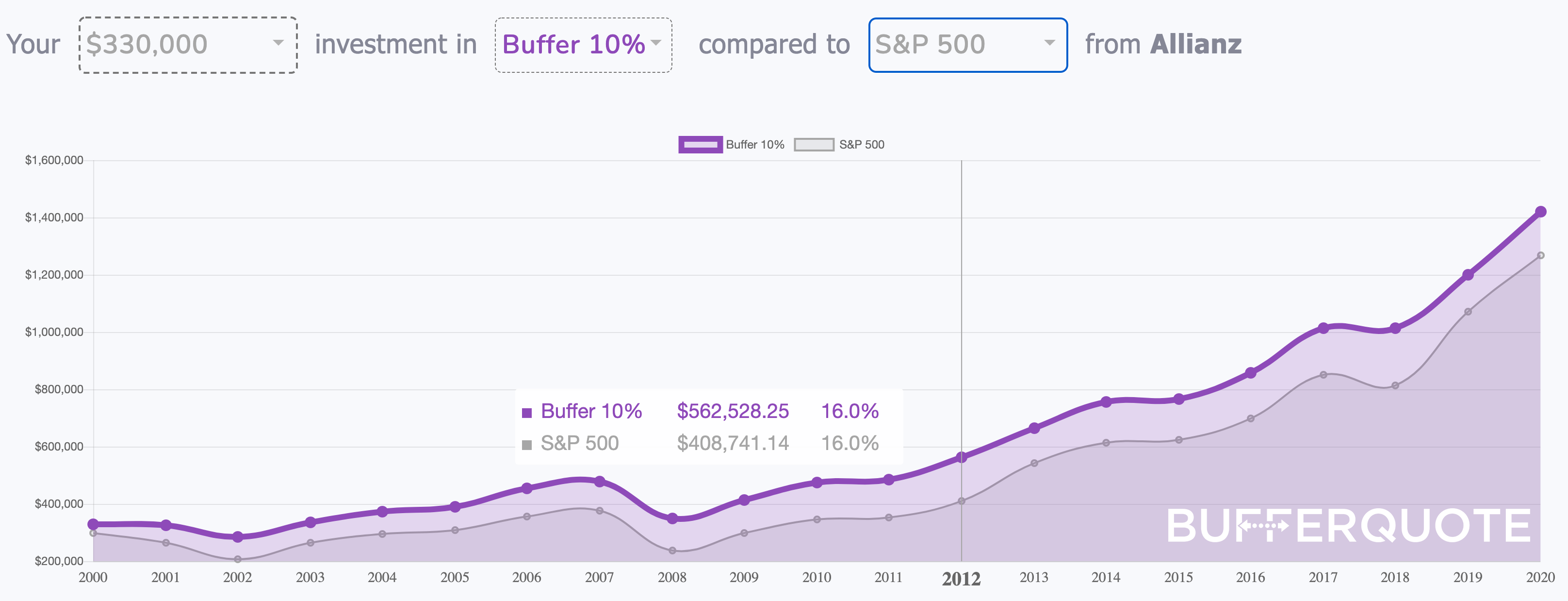

Taken from the interactive chart above the buffer annuity invested in the S&P 500 index over the last 20 years gain more than $86,000 than the S&P 500 index. That was an increase of 45% gain from limiting market losses with the 20% market protection each year. Click the chart to see how it works.

Annuity Company Issuer Review: Allianz

Since this investment is usually for the long term such as 10 years, it is important that the annuity company itself is financially sound. The guarantees in the annuity are back by the insurance company and not from a government agency. However each state’s Guaranty Association has a dollar amount, usually $100,000, that it will refund if an annuity carrier went bankrupt. Think of it as a second layer of protection.

Sometimes their misspelled name as Alliance, but Allianz Life Insurance Company of North America has been keeping its promises since 1896. Today, it carries on that tradition, helping Americans achieve their retirement income goals with a variety of annuities and life insurance products. As a leading provider of fixed annuities, Allianz Life is part of Allianz SE, a global leader in the financial services industry with nearly 155,000 employees worldwide. Based on its revenue, Allianz SE is the 20th largest company in the world (Fortune Global 500, August 2010).

Sometimes their misspelled name as Alliance, but Allianz Life Insurance Company of North America has been keeping its promises since 1896. Today, it carries on that tradition, helping Americans achieve their retirement income goals with a variety of annuities and life insurance products. As a leading provider of fixed annuities, Allianz Life is part of Allianz SE, a global leader in the financial services industry with nearly 155,000 employees worldwide. Based on its revenue, Allianz SE is the 20th largest company in the world (Fortune Global 500, August 2010).

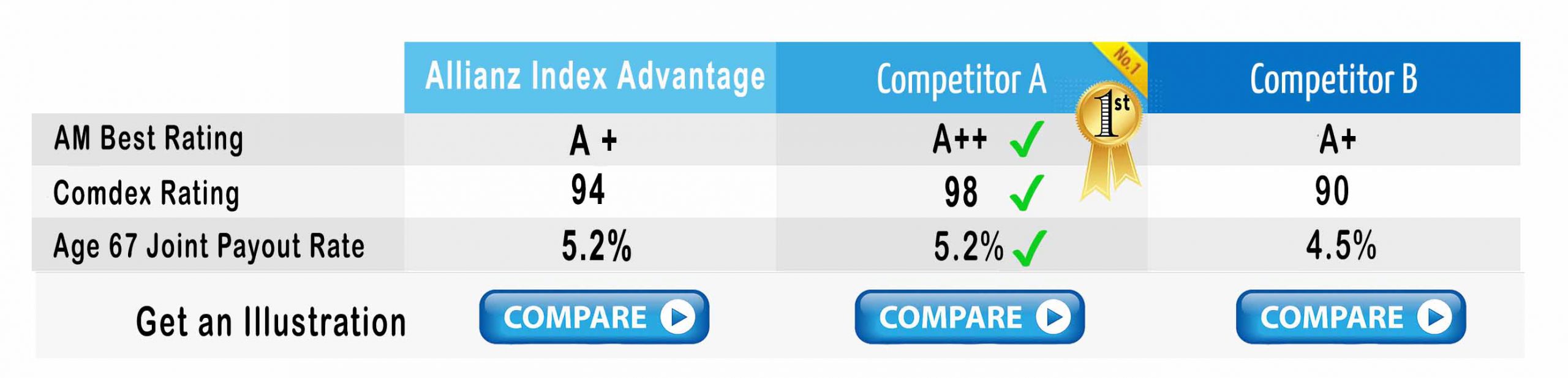

Allianz has an A.M Best rating as of April 2021 of A+ and a Comdex rating of 94.

Comparison:

Table below will update as the competition changes. Currently, there are some great choices for retirement annuities. To request a side by side, click on the compare button below, and our Retirement Income Certified Professional® will be happy to answer any question you might have (Click Here).

Surrender Fees:

Surrender charges/fees and periods for this annuity are the typical of most commissionable annuities. Most annuities will have a 5 year, 7 year, 10 year, and 14 year surrender variation to choose from. Taking the longer surrender period will most likely give you a larger cap on indexes and a larger fixed rate option for index crediting. Typically annuities allow you to withdraw 10% of your accumulation value after the first year without surrender fees. However if you are under age 59 and a half, you are subject to a 10% IRS tax penalty as well as income taxes applied to the withdrawal.

Allianz Indexed Advantage commissionable annuity (B-shares) have a 6 year surrender charge starting at 7% charge in the first year and second year following with a 1% reduction every year after that.

Fee-Only planners have access to “Advisory or I- share fee advised” structured annuities, They usually have zero surrender charges, instant liquidity, and higher index rates. These planners charge annual fees to manage the indexes around 1.00% per year of assets in the annuity. Still, a better option as these fee-only RILA annuities have higher upside cap rates than the commissionable traditional RILA/ buffer annuities. Check out BufferQuote.com for available fee-only buffer annuities

Earning Interest:

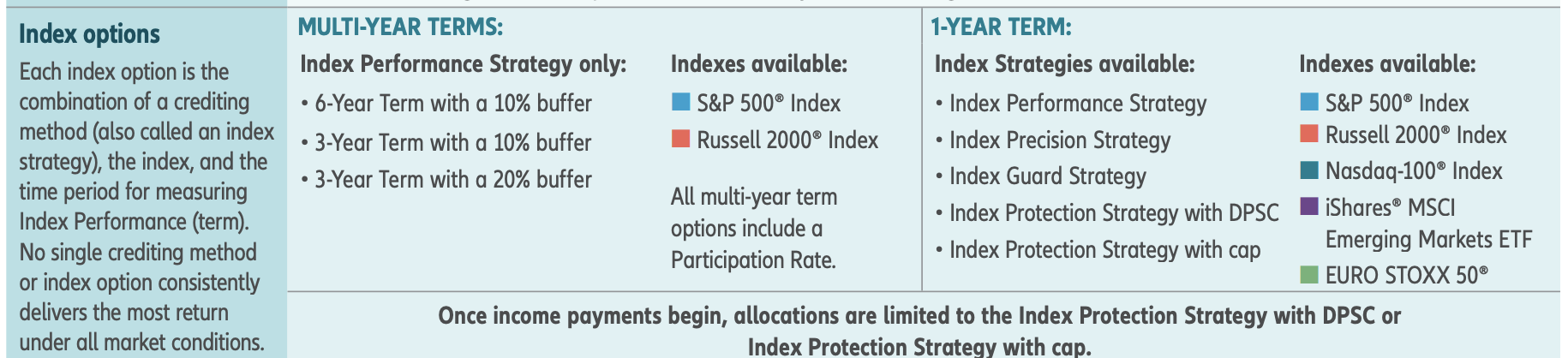

Index Advantage is a customizable indexed variable annuity that allows you to make choices based on your individual retirement needs and change themes those needs evolve.

One of the most valuable aspects of Indexed Advantage is its potential to cushion your account against loss. With Allianz Index Advantage index strategies, you can select a level of protection, called a buffer, which may help limit loss in down markets, partially shielding your account in the case of a negative index return.

With the help of the buffer, your risk of loss could be lessened. You also have the opportunity to grow your money in up markets by choosing from index strategies.

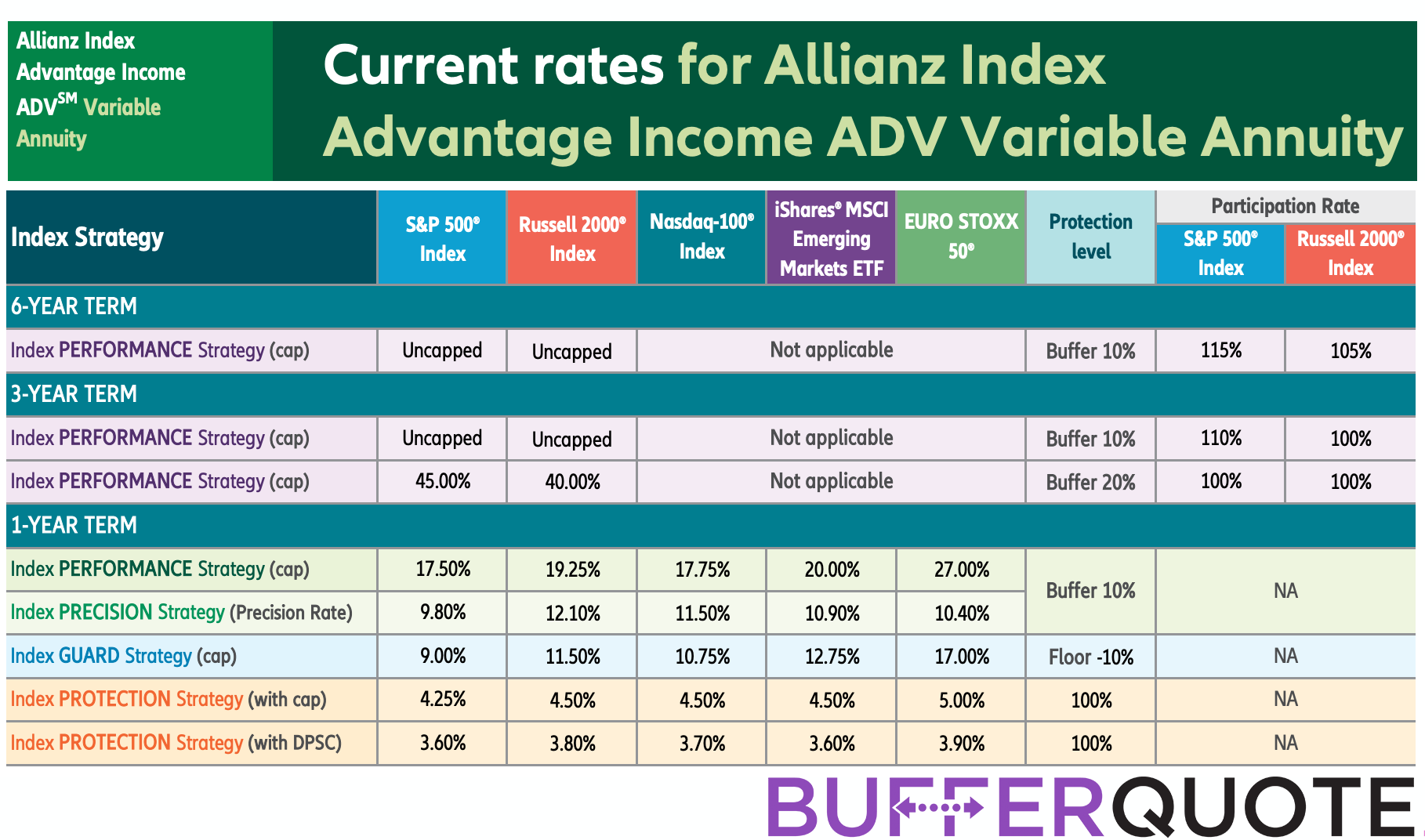

1-YEAR TERM STRATEGIES:

Index Performance Strategy

- Provides greater performance potential, based on a cap, among 1-year term strategies

- Provides a level of protection with a buffer that absorbs the first 10% of negative index performance

- This strategy may perform best in a strong market with protection from smaller index losses

Index Precision Strategy

- Offers the same level of protection and 10% buffer as the Index Performance Strategy

- Credits an annual predetermined Precision Rate if the change in the annual index value is zero or positive

- This strategy may perform best in a low growth environment with protection from smaller index losses

Index Guard Strategy

- Offers upside potential that may be matched or exceeded only by the Index Performance Strategy

- Provides a level of protection with a 10% floor which means you assume the first 10% negative index loss and no more

- This strategy may perform best in a strong market with protection from large index losses

Index Protection Strategy with cap and Index Protection Strategy with Declared Protection Strategy Credit (DPSC)

- These provide the most protection with no losses due to negative market index returns

- Offers modest growth potential with a DPSC relative to the other strategies

Once income payments begin, allocations are limited to the Index Protection Strategy with DPSC or cap.

Each index strategy determines how your money can grow and calculates the interest you can earn differently.

Index Advantage also enables you to diversify where you put your money by allocating across well-known indices. S&P 500, MSCI EAFE, EURO STOXX 50®, iSHARES RUSSELL 2000 ETF, and Nasdaq 100. Because different indices perform differently under similar market conditions, diversification can help improve your opportunity for growth.

How to use this annuity for retirement?

Fixed annuities provide an attractive and simple way to plan for retirement, With the help of optional features, such as riders and accounts that provide additional benefits based on what best suits your need at any given time during retirement planning. These products can be used in conjunction with other investments like bonds or fixed-income assets while still offering the benefits of long-term financial stability that comes from investing in one investment option only.

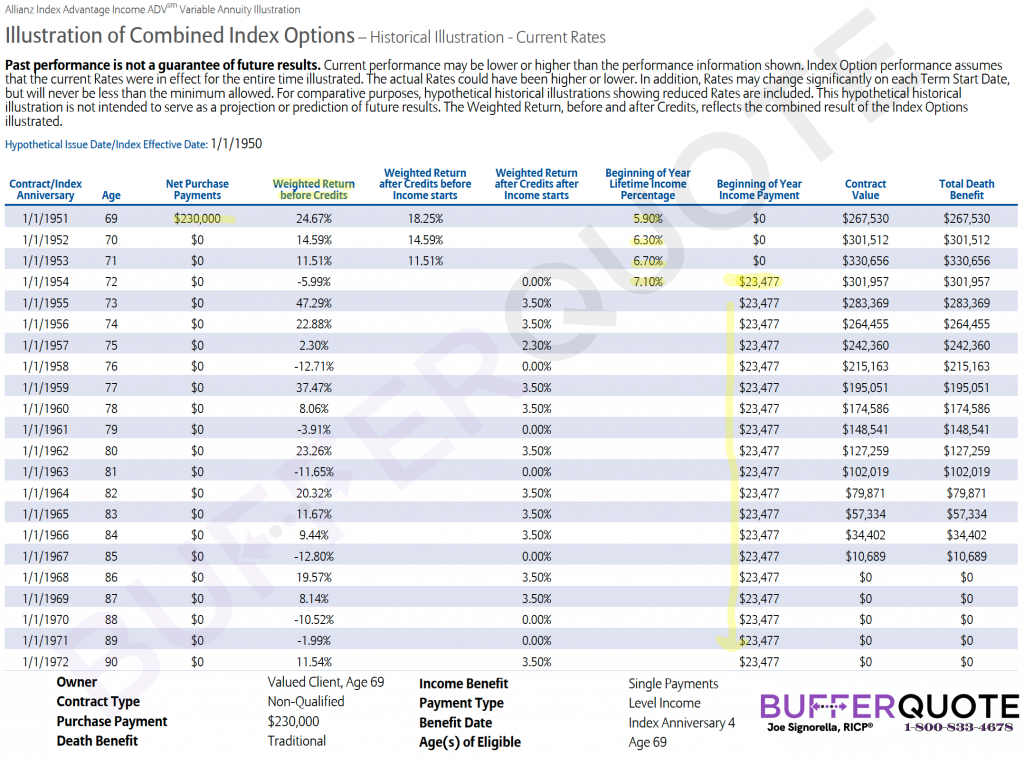

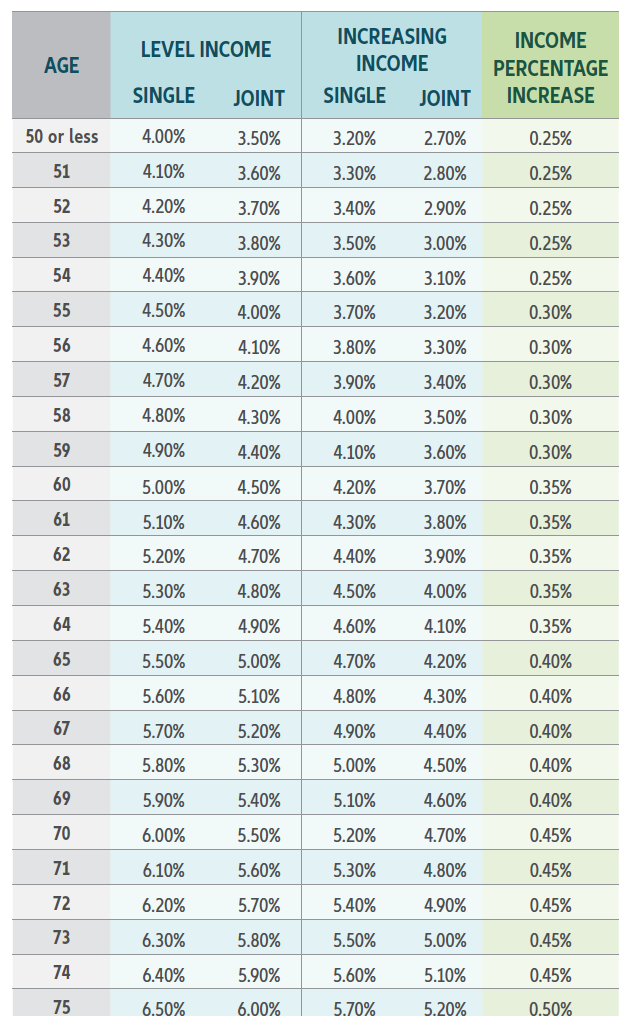

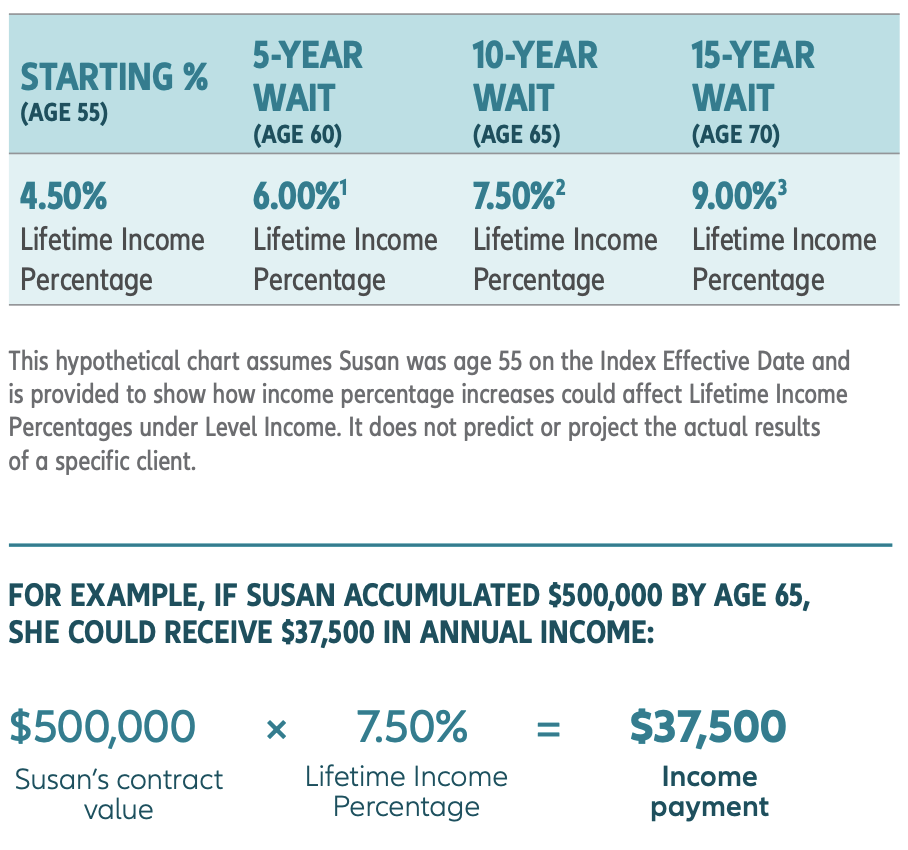

Index Advantage Income ADV can help you safely secure your retirement even if the markets are unstable. With Index Advantage Income ADV, your Lifetime Income Percentage has the opportunity to increase each year, even if your retirement assets fluctuate.  Beginning at age 45, the annuity provides a guaranteed income percentage increase in each of your Lifetime Income Percentages for each year you wait before beginning income payments. Index Advantage Income ADV is a great way to get your rewards when you’re patient. This chart compares options for Level Income and Increasing Income. It shows the income percentages and the annual income percentage. increases to those percentages based on the payment option and the age on the Index Effective date.

Beginning at age 45, the annuity provides a guaranteed income percentage increase in each of your Lifetime Income Percentages for each year you wait before beginning income payments. Index Advantage Income ADV is a great way to get your rewards when you’re patient. This chart compares options for Level Income and Increasing Income. It shows the income percentages and the annual income percentage. increases to those percentages based on the payment option and the age on the Index Effective date.

Allianz Index Advantage Income ADV Variable Annuity with a single purchase payment and does not take any withdrawals prior to retirement. Reassurance of level and dependable income for life, Level Income

payments are selected. Not knowing when to receive income payments, available Lifetime Income Percentages can increase by 0.30% for every year you wait with Indexed Advantage Income annuity.

Fiduciary Annuity and Retirement Income Planning Information From a RICP®

In 2017 Department of Labor’s fiduciary rule being struck down in federal court of Appeals has been especially helpful in the sales of indexed annuities. The rule, which raised investment-advice standards in retirement accounts, would of made brokers and insurance agents become fiduciaries to sell indexed annuity and other financial products opening up potential lawsuits from “bad” sales of annuity products. Unfortunately, that didn’t rule holding agent up to a higher standard, as a fiduciary, did not pass.

Our annuity review also called “look” is overseen by our in house Retirement Income Certified Professional® that has to put you first, as a fiduciary so you will have the confidence to use these annuities in your retirement plan after our reviews. Let’s get to it.

The Agent sales pitch for this annuity?

This indexed variable annuity, also called an Registered Indexed Linked annuity, RILA, Buffer annuity, will likely be presented on three ideas:

- Protect – Select a level of protection that will limit losses

- Grow- Participate in the limit upside of market indexes

- Lifetime Income

The Allianz Index Advantage Variable Annuity is for investors that want to participate in stock market like return with a loss provision or buffer selected of 10% or 20% a year.

Remember that the index credits are capped at a lower rate than the index itself like your index mutual funds or EFT at Charles Schwab or Fidelity. They are options held on the indexes at the annuity carrier’s investment department. Most indexes described above will NOT include the dividends which historically represent some returns in the case of the S&P 500 index. Because this a tax-qualified annuity gains are tax-deferred until income/money is taken out of the annuity.

Summary:

When you’re looking to secure your future, it pays to do research. This is especially true when there are long-term financial products like annuities that can be so important to retirement. The financial markets can be unpredictable, but your future retirement income will always remain safe with an annuity-like Allianz Indexed Advantage.

This product offers a market-like rate of return and indexing investments. The income feature of Allianz Index Advantage Income ADV gives guranteed lifetime income for retirement.

I hope you found this look informative and found value in your time. Aloha!

Have questions about this Annuity?

If you’re considering this annuity and have additional questions, feel free contact us via our secure contact form. Our Retirement Income Certified Professional (RICP®) will answer your questions FREE within 24 hours. I hope you found this look informative and found value in your time. Aloha!

Our lawyers made us do it, some legal disclosures…

This is an independent product review, not a recommendation to buy or sell an annuity. The annuity carrier has not endorsed this review in any way, nor do we receive any compensation for this review. This is an independent review for you to see the pros and cons of this particular annuity. Before purchasing any investment product be sure to do your own due diligence and consult a properly licensed professional, preferably a certified financial planner® practitioner, should you have specific questions as they relate to your individual circumstances. Values shown are not guaranteed unless specifically stated otherwise. Rates and annuity payout rates are subject to change. Actual values may be higher lower than the values shown. The illustration is not valid without all pages and the statement of understanding. Not available in all states.

All names, marks, and materials used for this review are the property of their respective owners. Annuity product guarantees rely on the financial strength and claims-paying ability of the issuing insurer. Annuity riders may be available for an additional annual premium that can provide additional benefits and income guarantees. By contacting us you may speak with an insurance licensed agent in your state, and you may be offered insurance products for sale.