-Look by Joe Signorella, RICP®

What Will We Cover in this Annuity Review?

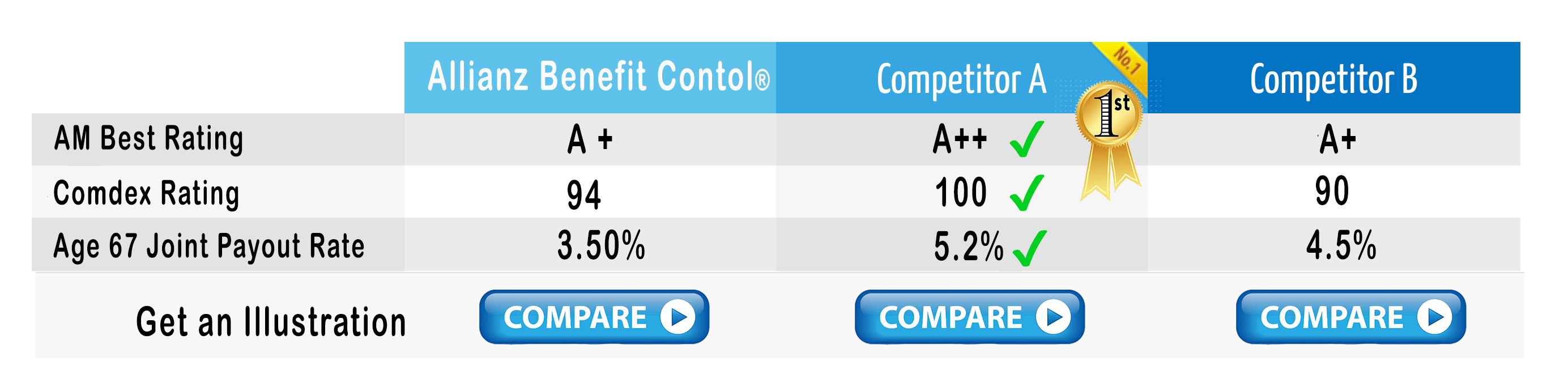

In this annuity review we will be going over annuity details regarding the Allianz Benefit Control annuity.

- Investment type

- Rates

- Optional Riders

- Fees

- Return expectations

In 2021, total annuity sales in the United States reached a record high of $69 billion. This is 40% more than last year and it represents one of many strategies that can protect retirees against market volatility while securing lifetime income for them as well!

When shopping for annuities, it’s important to be aware that each product may have a different focus. For example one product could provide death benefit protection or income while another provides growth-oriented security – with both having the same name but differing features and rider options attached!

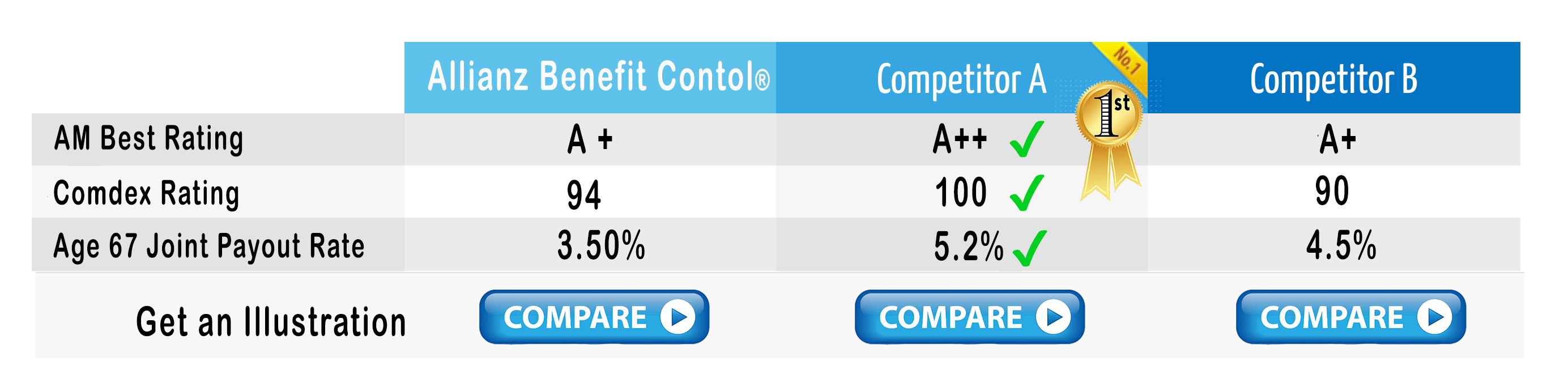

Annuity Company Issuer Review: Allianz SE and Allianz Life

Since this investment is usually for the long term such as 10 years, it is important that the annuity company itself is financially sound. The guarantees in the annuity are back by the insurance company and not from a government agency. However each state’s Guaranty Association has a dollar amount, usually $100,000, that it will refund if an annuity carrier went bankrupt. Think of it as a second layer of protection.

Sometimes their misspelled annuity as Alliance 222 annuity, Allianz Life Insurance Company of North America has been keeping its promises since 1896. Today, it carries on that tradition, helping Americans achieve their retirement income goals with a variety of annuities and life insurance products. As a leading provider of fixed index annuities, Allianz Life is part of Allianz SE, a global leader in the financial services industry with nearly 155,000 employees worldwide. Based on its revenue, Allianz SE is the 20th largest company in the world (Fortune Global 500, August 2010).

Allianz Life is part of Allianz SE, a global leader in the financial services industry with nearly 155,000 employees worldwide. Based on its revenue, Allianz SE is the 20th largest company in the world (Fortune Global 500, August 2010).

Since this investment is usually for the long term such as 10 years, it is important that the annuity company itself is financially sound. The guarantees in the annuity are back by the insurance company and not from a government agency. However each state’s Guaranty Association has a dollar amount, usually $100,000, that it will refund if an annuity carrier went bankrupt. Think of it as a second layer of protection. In 2021, total annuity sales in the United States reached a record high of $69 billion. This is 40% more than last year and it represents one of many strategies that can protect retirees against market volatility while securing lifetime income for them as well!

When shopping for annuities, it’s important to be aware that each product may have a different focus. For example one product could provide death benefit protection or income while another provides growth-oriented security – with both having the same name but differing features and rider options attached!

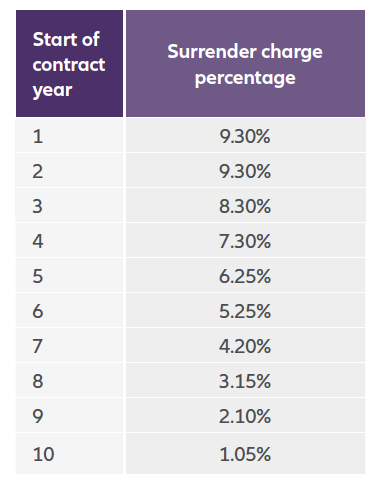

Surrender Fees:

Surrender charges/fees and periods for this annuity are the typical of most commissionable annuities. Most annuities will have a 5 year, 7 year, 10 year, and 14 year surrender variation to choose from. Taking the longer surrender period will most likely give you a larger cap on indexes and a larger fixed rate option for index crediting. Typically annuities allow you to withdraw 10% of your accumulation value after the first year without surrender fees. However if you are under age 59 and a half, you are subject to a 10% IRS tax penalty as well as income taxes applied to the withdrawal.

Allianz Benefit Control® annuity has only the 10 year surrender charge option starting at 9.3% charge in the first year and second year.

The commissions for annuities can range anywhere from 2% to 8% paid one time directly from the insurance company to the selling agent. As the buyer of an annuity, you would never pay anything directly to your financial planner, nor would the commission come off the value of your account. If you invest $100,000 into an annuity with a 4% commission, your starting value would still be $100,000 (or higher if the annuity gave a bonus).

Fee-Only planners have access to “Advisory or I- share fee advised” annuities that usually have zero surrender charges, instant liquidity, and higher investment rates. These planners charge annual fees to manage the indexes around 1.00% per year of assets in the annuity. Still, a better option as these fee-only annuities have higher upside cap rates than the commissionable traditional annuities. Message us here to see if we have an available fee-only annuity.

Earning Interest:

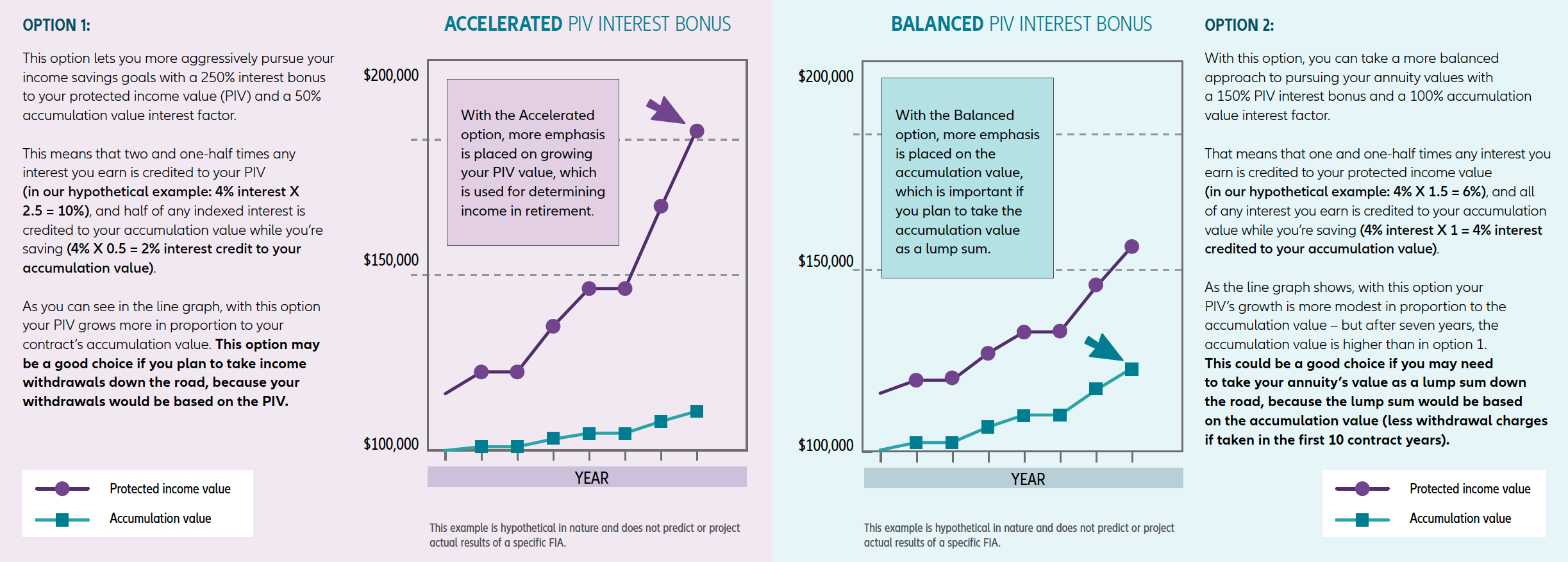

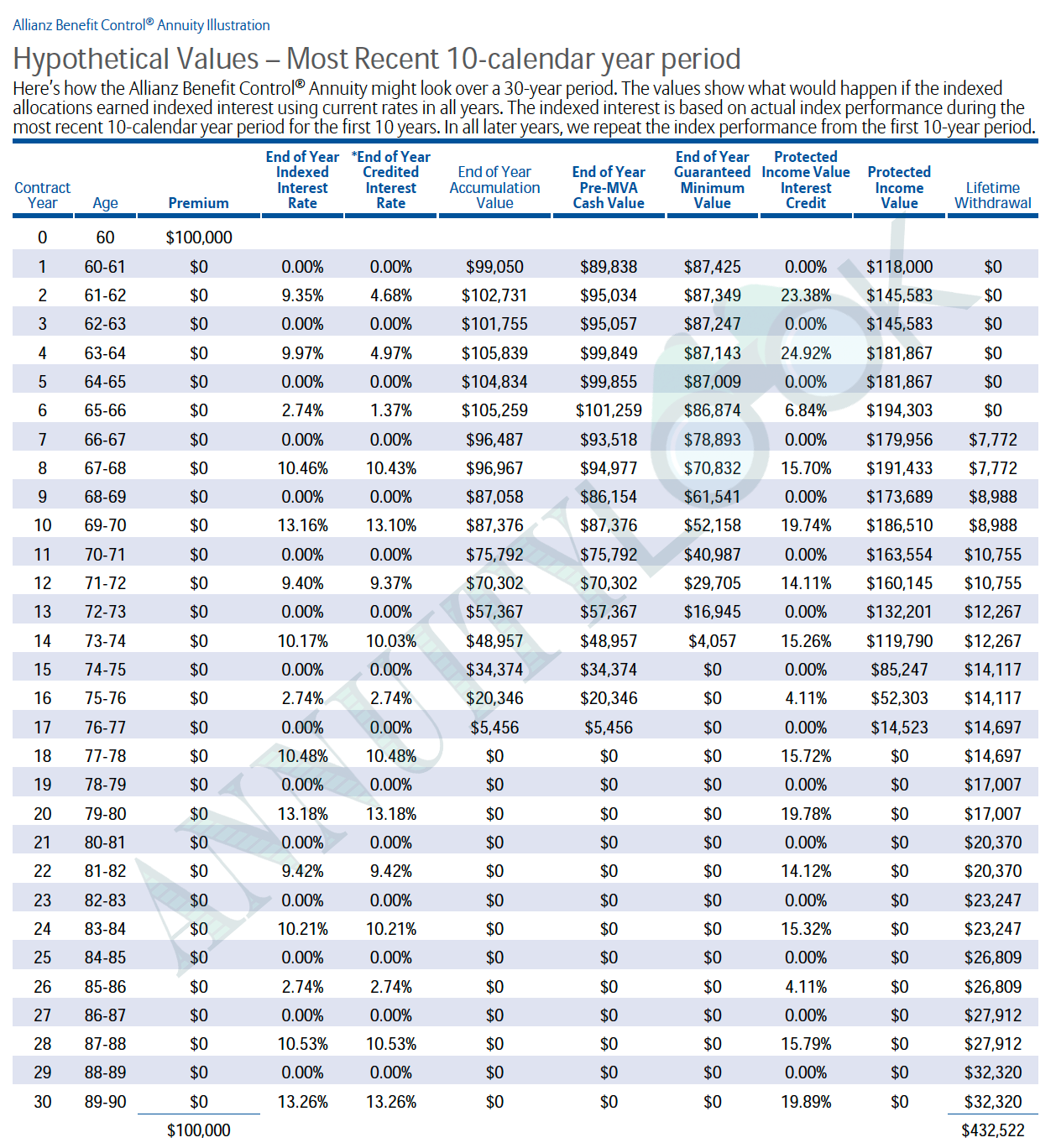

If you’re looking for a way to increase your retirement income, the Allianz Benefit Control Annuity is the perfect solution. This fixed indexed annuity gives policyholders the ability to begin income on any monthly contract anniversary after age 50, with no minimum waiting period. Two Lifetime Income Rider Options are available while the client is accumulating assets. Accelerated Protected Income Value rider allows you to receive 50% accumulation value interest factor. The annual payment amount will increase following any years there is fixed and/or indexed interest credited and will receive the 250% interest bonus. This means they can access the full PIV immediately or on any monthly anniversary by electing either single or joint lifetime with no surrender charges. With the Balanced Protected Income Value rider the PIV can receive two bonuses, a premium bonus on any premiums in the first 18 months and 100% interest for as long they own their contract. After age 50 your client has access to his/her protected income immediately or monthly anniversary by choosing either single-life withdrawals with 150%. After reaching 70 there is fixed + indexation Interest credited which increases accelerated option’s potential annual payments up until death – receiving both 175%, guaranteed if accepting this rider.

The Allianz Income Multiplier (AIM) benefit can double their annual maximum lifetime income withdrawal if confined to a qualifying nursing home, hospital or assisted living facility for at least 90 days in consecutive 120-day period. If you’re unable perform two out of six ADLs then it will be worth claiming this extra protection!

The Agent sales pitch for this annuity?

This indexed annuity, also called an equity-indexed annuity, FIA, fixed-index annuity or hybrid annuity, will likely be presented on three ideas:

- Principle protection with upside potential from index choices

- Death Benefit & Income features

- Potential bonus money

The Allianz Benefit Control annuity is for investors that don’t want to worry about market volatility and will not need access to their money for longer than a handful of years.

Agent for this annuity have to tendency to inflate the index return rates. Remember that the index credits are capped at a lower rate than the index itself. Indexes are not being held like your mutual funds at Charles Schwab or Fidelity. These are options held on the indexes at the annuity carrier’s investment account for department. Most indexes described above will NOT include the dividends which historically represent partial returns in the case of the S&P 500 index. Over the long term, this annuity will generate returns of 0-6%. Anything more is misleading.

Fixed annuities provide an attractive and simple way to plan for retirement, With the help of optional features, such as riders and accounts that provide additional benefits based on what best suits your need at any given time during retirement planning. These products can be used in conjunction with other investments like bonds or fixed-income assets while still offering the benefits of long-term financial stability that comes from investing in one investment option only.

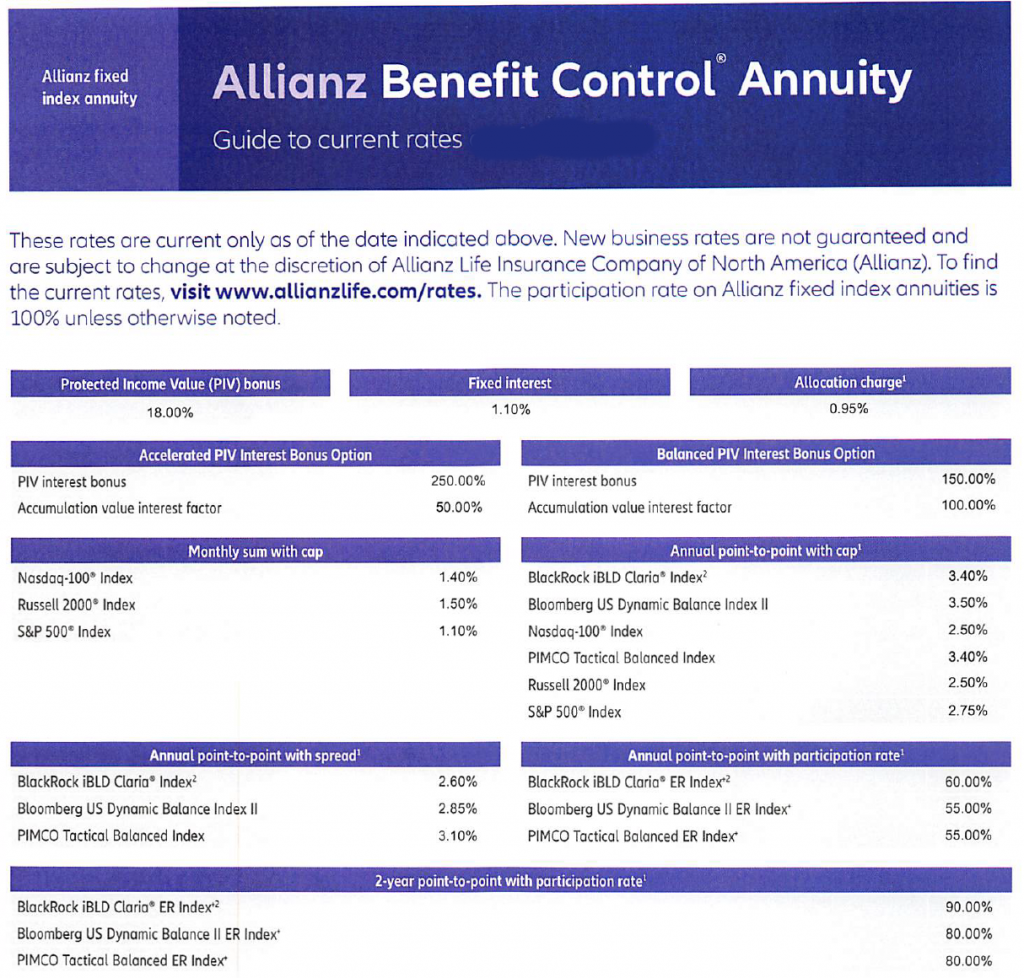

See current Allianz Benefit Control rates here

Frequently Asked Questions About the Allianz Benefit Control Annuity:

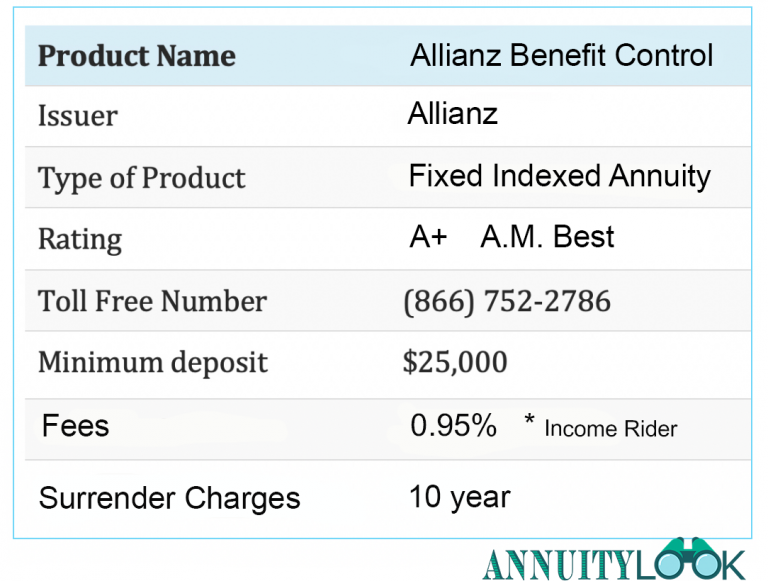

Q: What is the minimum premium I need to pay?

A: $25,000 if Qualified funds, $25,000 if Non-Qualified funds

Q: Am I paid a bonus on my initial premium at sign-up?

A: YES.

Q: Can I pay additional premium later on?

A: Yes, but only during the first contract year at a minimum of $500 each time.

Q: Are there any age restrictions?

A: Yes. You can purchase this annuity up to age 80. In some states the age requirements may differ.

Q: In which states is the Allianz Benefit Control annuity available?

A: The Allianz Benefit Control annuity is not available in all states. Call 800-833-4678 to find out if it’s available in your state.

Q: Does this annuity have an income rider (for withdrawing income)?

A: Yes.

Q: For how long are surrender charges in effect?

A: 10 Years

Q: Does the Allianz Benefit Control annuity permit any withdrawals without penalties?

A: Yes. Up to 10% of the accumulation value annually free of withdrawal charges.

Q: What benchmark indices do the Allianz Benefit Control offer?

A: S&P 500 and Multi-Strategy

Q: What are the index account options?

A: Annual Reset Monthly Sum, Annual Reset Point-to-Point, Annual Reset Monthly Averaging, and Fixed Account Interest Rate.

Q: What is the Method for Crediting Interest or Gains?

A: Cap rates.

Have questions about this Annuity?

If you’re considering this annuity and have additional questions, feel free contact us via our secure contact form. Our Retirement Income Certified Professional (RICP®) will answer your questions FREE within 24 hours.

Summary:

When you’re looking to secure your future, it pays to do research. This is especially true when there are long-term financial products like annuities that can be so important to retirement. The financial markets can be unpredictable, but your future retirement income will always remain safe with an annuity Allianz Benefit Control.

This product offers a comfortable rate of return and indexing investments to ensure that you never have to worry about losing money in a down market. Additionally, it comes with peace-of-mind knowing won’t lose out on your saving in retirement.

I hope you found this look informative and found value in your time. Aloha!

Our lawyers made us do it, some legal disclosures…

This is an independent product review, not a recommendation to buy or sell an annuity. The annuity carrier has not endorsed this review in any way nor do we receive any compensation for this review. This is an independent review for you to see the pros and cons of this particular annuity. Before purchasing any investment product be sure to do your own due diligence and consult a properly licensed professional, preferably a certified financial planner® practitioner, should you have specific questions as they relate to your individual circumstances. All names, marks, and materials used for this review are the property of their respective owners.